Headwinds Become Tailwinds - 3 Important strategies for 2023

- Stocks will likely turn positive before the economy.

Every recession is painful in its own way, but one potential bright spot is that they don’t historically last very long. Our (Capital Group) analysis of 11 U.S. cycles since 1950 shows that recessions have ranged from 2 to 18 months, with an average lasting about 10 months.

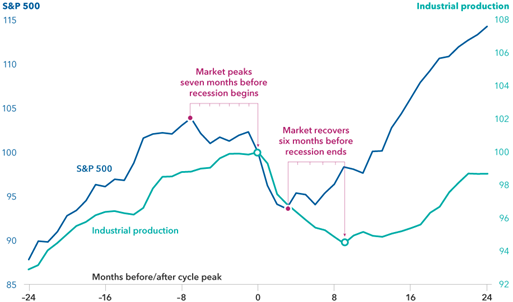

What’s more, stock markets usually start to recover before the recession ends as they are predictive mechanisms. Stocks have already led the economy on the way down in this cycle, with nearly all major equity markets entering Bear Market territory by mid-2022. If history is any guide, they could rebound about 6 months before the economy does.

- Don’t sit on the sidelines

A steady drumbeat of bad news can be discouraging to even the most seasoned investors. But well-managed companies adjust to shifting conditions, and ultimately the best companies have learned to thrive in the new reality. Markets themselves have a history of adjusting to setbacks. Indeed, stock markets historically recover before the recession ends, anticipating a better future ahead.

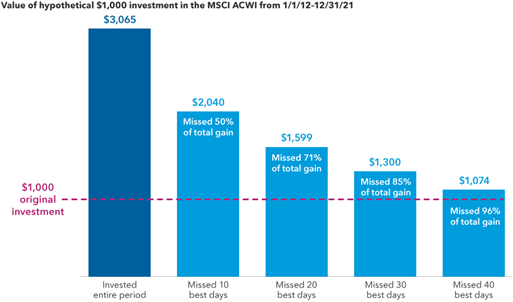

What is important for investors going forward is to stick with their long-term investment plans. Abrupt and dramatic change often triggers powerful emotions that can lead to impulsive investor actions, like moving assets to the sidelines (cash). From May 2022 through the end of the year, (U.S.) investors shifted about $160 billion into money market funds, according to the Office of Financial Research. But taking your money out of the market on the way down means that if you don’t get back in at exactly the right time, you can’t capture the full benefit of a recovery.

Missing just a few of the markets best days can hurt investment returns.

- Recessions are inevitable, but the pain won’t last forever

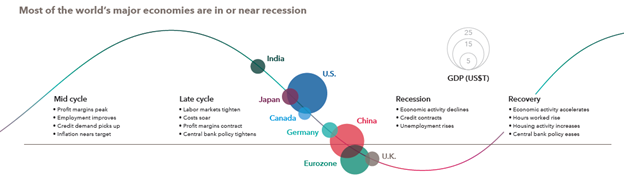

The global economy certainly appears to be headed in that direction. Europe is likely already in a recession, exacerbated by the war in Ukraine. China’s growth has decelerated essentially to zero, pressured by rolling COVID-19 lockdowns. The U.S. economy, while stronger than most, appears headed for a downturn as elevated inflation and higher interest rates take their toll.

Capital Group economist Jared Franz expects the U.S. economy to contract by about 2% in 2023 — worse than the post-tech and telecom bubble recession of the early 2000s, but not nearly as bad as the 2008–09 financial crisis. The important thing to remember, Franz stresses, is that recessions set the stage for the next period of growth.

“Today, the stock market is reflecting a more realistic view that a recession is looming,” Franz adds. “But, historically speaking, stocks also tend to anticipate a brighter future ahead, long before it becomes clear in the economic data.”

sources: Capital Group, FactSet. GDP data are in USD and are the latest available through 9/30/22. Country positions within the business cycle are forward-looking estimates by Capital Group economists as of November 2022.