News and Noise

News

- Banking failures.

- Banking failures have and will occur because of a dramatically inverted yield curve which has caused banks to realize losses in bond holdings. This has put some banks who have heavily invested in the bond market over the previous few years, realize the losses from a higher, but inverted rate curve.

- If nothing changes, nothing changes.

- This is the awkward phase of the cycle which historically seen the Central Banks raise rates until something ‘breaks’. Is this the ‘break’ that will cause central banks to pivot? It is too early to tell but the economy must clean house post covid economy which was heavily supported by Government subsidies and interventions in the economy. .

- This instability is normal and is necessary.

- This is an important part of the cycle must run its course, in order for markets to rise to new highs. Which it always has historically.

- People are working hard on your behalf.

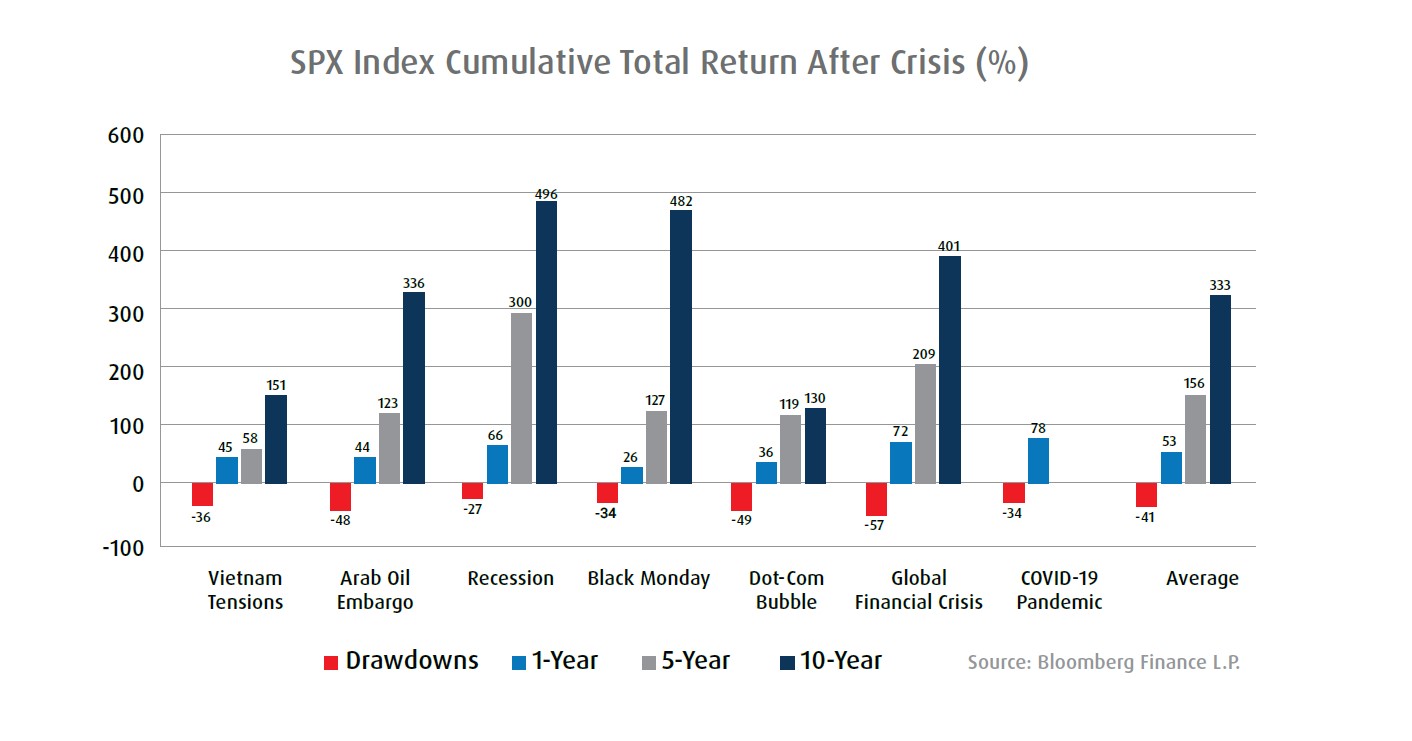

- We and fund managers realigned portfolios months ago in anticipation of volatility while maintaining exposure to post recession growth. It is time in the market that matters, not timing the market.

Noise

- GICs offer better returns.

- With GICs paying 4%-5%, it seems attractive. Yields in the bond market have seen the yield to maturity now paying 5%-8% with the potential for additional capital gains.

- Equities fall during a recession.

- Actually Equities tend to fall most before the recession as the Stock Market is a predictive mechanism. Expect continued volatility, in both directions, for the remainder of 2023 as these imbalances are worked through the economy.

- Something dramatic should be done to portfolios.

- The repositioning of portfolios and funds has already been underway both by us with the addition of new strategies as well as fund managers realigning their funds for post recession growth. This is not the time to attempt timing the market.

Mackenzie Global Investment Committee Special Insert - March 17, 2023

In light of the recent events in the US regional banking sector and the mounting concerns around Credit Suisse, the Mackenzie Global Investment Committee(GIC) held an impromptu meeting on March 15th to assess the current market environment and whether any immediate action should be taken.

In the near term, we believe volatility will remain elevated and is the primary driver for our rationale to maintain a neutral stance in our equity to fixed income positioning. In these types of highly charged environments it is particularly important to not act in haste but rather to take stock of current positioning and assess the risks.

The committee is focusing on implications on an intermediate time horizon of 6 to 12 months. To that end prior to these events our view was economic growth was likely to slow and this would result in some downward pressure on margins and earnings, resulting in greater equity volatility. We expected that equities could well remain in a trading range bounded by the October 2022 lows and early February highs. Further, bonds would likely provide some ballast to the equity volatility. To some degree this is what has played out since the GIC meeting in February but we certainly did not predict the current series of events in the global banking sector.

We do think the risk of recession occurring in the next six to 12 months has increased. Notwithstanding the decline in market yields, financial conditions have tightened materially, there will be pressure on bank margins, and the availability of credit will be reduced which undoubtedly will be a headwind for economic growth and in turn risk assets.

However, that needs to be balanced against the pending path of monetary policy. If the market becomes confident that the Fed and other central banks will indeed pivot this will support risk assets to some extent. We are monitoring conditions closely and will have further commentary post our upcoming meeting on March 23rd which will have the benefit of increased clarity from the Fed’s response to recent events.